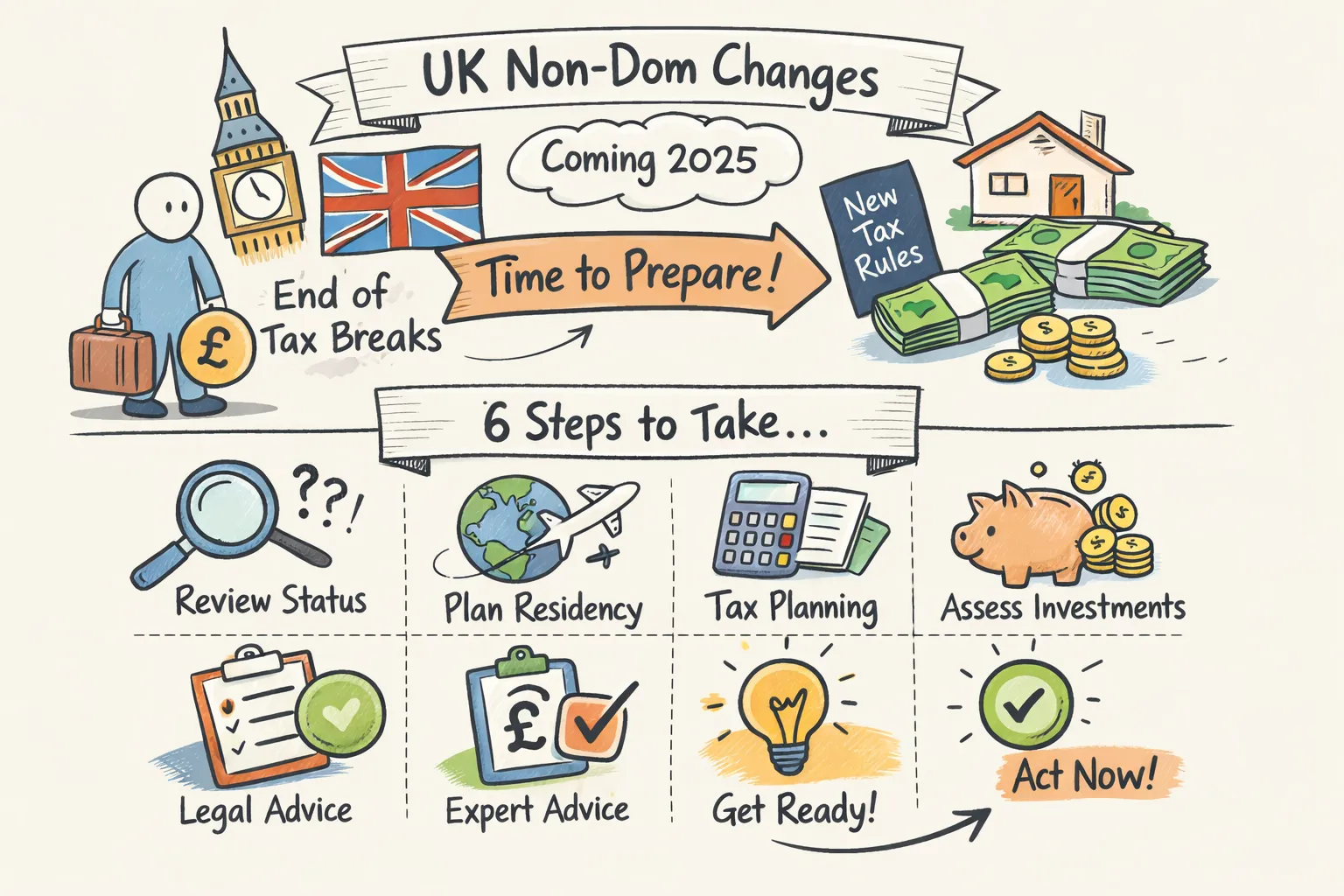

The single-line change: from 6 April 2025 the UK’s domicile-based tax regime and the remittance basis were abolished, replaced by a residence-focused system. If you’ve used offshore structures, kept foreign income abroad, or relied on “non-dom” rules to limit UK tax, this is a material change — not a tweak. By the end of this guide you’ll understand what used to matter, what the new Foreign Income and Gains (FIG) rules do, whether you’re likely to be affected, and six concrete steps you can take now to reduce risk. ExpatsUK has a free downloadable checklist and community threads that mirror this guide — use them to track deadlines and crowdsource adviser recommendations.

What “non‑dom” actually meant — a concise refresher

For many internationally mobile people the remittance basis was the defining feature of UK tax: UK tax on UK income and only on foreign income or gains that you physically brought into (or used in) the UK. That created predictable behaviours — keep foreign income offshore, use offshore trusts and mixed funds, and carefully trace any remittances before spending here.

The Remittance Basis Charge (RBC) made the choice clearer for long‑stayers: pay a flat charge (historically £30,000 or £60,000 depending on years of residence) in return for continuing to use the remittance basis and avoid UK tax on offshore sums. Reforms since 2017 then introduced “deemed domicile” for long‑stayers, narrowing the safe havens for those who had been away for many years.

Simple before‑and‑after snapshot: before 2025 you could lawfully hold foreign dividends offshore and avoid UK tax until you remitted them; after 6 April 2025 domicile ceases to be the tax pivot and the old remittance rules no longer govern future taxation (though transitional measures apply to pre‑2025 amounts).

The headline change on 6 April 2025 — legislation and the big picture

Chancellor announcements in the 2024 Spring Budget and the subsequent Finance Act implemented a clear switch: the UK moved from a domicile‑centred approach to a residence‑based model, effective for the 2025/26 tax year starting 6 April 2025. The government’s stated aim is a simpler, fairer system where residence — not an often‑controversial domicile test — governs ongoing taxation.

In practical terms the old framework fell away and a new set of rules landed. The remittance basis and RBC were removed for future taxation; deemed domicile was abandoned and replaced with tests that define long‑term resident status; and a targeted relief — the new FIG regime — was introduced to protect certain “new arriver” residents for a limited period. If you’ve used trusts, offshore income vehicles or mixed funds, these structural changes mean you need to revisit past planning and current recordkeeping quickly.

The Foreign Income and Gains (FIG) regime — plain English explanation

The FIG regime is the key safe harbour for people who are newly returning to or newly joining UK tax residence after a long absence. Put simply: if you meet the “new arriver” test you get up to four UK tax years during which specified foreign income and gains arising in those years are exempt from UK tax.

Who typically qualifies? The FIG test is strict: to be a qualifying resident you must have been non‑UK tax resident for at least 10 consecutive prior tax years (it’s all‑or‑nothing). The FIG exemption then applies to foreign income and gains arising in the first four UK tax years of residence after that 10‑year absence. The trade‑off is real: claiming FIG normally means you lose personal allowances and other UK reliefs that only apply to the arising basis.

What counts as FIG in practice? Examples include interest on foreign bank accounts, dividends from non‑UK companies, capital gains on overseas assets, and many trust distributions sourced from abroad. It does not apply to UK‑sourced income — earnings from UK employment or UK property remain taxable in the UK as usual.

How do you use it? FIG is a claim on your Self‑Assessment tax return for the relevant year; it is not an automatic default. Timing matters: apply in the tax year when the income/gain arises and keep supporting documentation, because HMRC will expect a clear chain of where income was earned and when it was taxed (if at all) overseas.

Transitional rules and deadlines you must not miss

There is a narrow window of transitional protections — and a few traps. Below are the pivotal dates and what they mean for trustees, asset owners and returnees.

| Date / Period | What happened or applies | Why it matters |

|---|---|---|

| 30 October 2024 | Cut‑off for grandfathering certain trust protections and excluded property definitions. | Trusts and gifts fully funded before this date may retain excluded status; additions after this date generally lose protection. |

| 6 April 2025 | Effective date for abolition of remittance basis and domicile-based rules. | From this tax year, worldwide arising taxation applies unless FIG or other reliefs qualify you otherwise. |

| 2025/26–2027/28 (TRF window) | Temporary Repatriation Facility (TRF) open; designated pre‑2025 untaxed foreign amounts can be taxed at reduced flat rates. | Designate and pay 12% in 2025/26–2026/27 or 15% in 2027/28 to allow later untaxed remittances without further UK tax. |

| Rebasing to 5 April 2017 (disposals from 6 Apr 2025) | Certain taxpayers who claimed the remittance basis between 2017 and 2024/25 may use 5 Apr 2017 values for CGT. | Can materially reduce CGT on later disposals; eligibility depends on prior remittance basis history and asset location rules. |

Practical warnings: don’t add new assets to pre‑30‑October‑2024 trusts if you expect them to retain excluded status; don’t assume historic offshore sums are safe without checking whether you can use the TRF; and if you have significant foreign assets consider whether rebasing is relevant before you dispose.

Six immediate, practical steps to protect your tax position

Confirm your residency history and evidence

Why this is urgent: FIG eligibility and long‑term resident status rely on a precise 10‑year residence count. Disputes with HMRC turn on documentary proof, not good intentions.

This week: compile a timeline of tax years showing where you were tax resident; collect passports, entry/exit stamps, flight records, utility bills, lease agreements, and foreign tax filings that back the dates.

Ask your adviser: can my timeline be certified for FIG purposes? Is any documentary gap likely to be accepted by HMRC or will I need additional corroboration?

Run a quick FIG eligibility model

Why this helps: knowing whether you pass the “10‑year non‑residence” test determines whether you get four years of FIG protection and therefore changes your planning choices immediately.

This week: sketch likely overseas income and gains for each of your first four UK tax years (include interest, dividends, trusts and planned disposals). Model the tax cost if you were taxed on the arising basis versus the benefit of FIG.

Ask your adviser: given my expected overseas receipts in year 1–4, is FIG materially better than immediate arising taxation? What happens if I lose residency for a year during that period?

Decide on TRF designation for pre‑2025 untaxed amounts

Why this matters: if you have unremitted pre‑6 April 2025 foreign income or gains that previously escaped UK tax under the remittance basis, the TRF offers a one‑time route to repatriate at a low flat rate rather than face complex tracing rules later.

This week: identify the scale of pre‑2025 untaxed offshore amounts and ask your bank for statements showing those balances and transaction history; get a pro‑forma TRF calculation from a tax adviser comparing the 12%/15% cost to the risk of later taxation.

Ask your adviser: am I eligible to designate these amounts under the TRF? Which tax years should I use to pay the TRF to minimise total present value? How will trust distributions be treated if my funds sit in a trust?

Consider the CGT rebasing election and timing for disposals

Why this could save you money: for qualifying assets the base cost can be locked to 5 April 2017, potentially reducing capital gains charges on disposals made after 6 April 2025.

This week: list foreign assets bought before 5 April 2017 and capture broker statements, dated valuations, and acquisition invoices. Don’t dispose of large holdings before you’ve checked the rebasing math with an adviser.

Ask your adviser: do I meet the remittance‑basis claim history needed to qualify for 2017 rebasing? If so, should I elect rebasing for a particular disposal or keep the default?

Review trusts and estate‑planning arrangements now

Why trustees and settlors must act: the 30 October 2024 cut‑off matters for excluded property and grandfathering. Additions after that date risk losing historic protections.

This week: identify any trusts you’ve settled or funded before 30 October 2024 and confirm whether assets added after that date exist. Ask trustees not to accept further settlor additions until you’ve had legal advice.

Ask your adviser: which trusts remain “excluded property”? If additions have already happened post‑cut‑off, can we restructure or mitigate IHT exposure?

Prepare your next Self‑Assessment and engage a specialist adviser

Why early engagement reduces error: FIG claims, TRF designations and rebasing interplay with your SA return and late filings get expensive and risky.

This week: assemble the documents above and draft a short brief for an adviser summarising your residency timeline, trust positions, unremitted funds and major disposals planned for 2025–2028.

Ask your adviser: what wording should I use on my Self‑Assessment for FIG or TRF claims? Which deadlines must I meet to preserve rebasing or make protective claims for 2024/25?

Recordkeeping, elections and what to include on your Self‑Assessment

HMRC is practical but forensic; clear records protect you. Gather original material and keep readable digital copies in a logical folder structure.

- Residency evidence: passport pages, flight records, tenancy agreements, utility bills covering the relevant tax years.

- Bank and brokerage statements showing dates and values of foreign receipts, remittances to the UK, and transfers between accounts.

- Trust documents: deeds, settlement dates, proof of funding before 30 October 2024, and any trustee minutes about distributions.

- Asset acquisition records and valuations as of 5 April 2017 (for rebasing), plus broker/dealer confirmations.

- Copies of prior remittance basis claims and past Self‑Assessment returns (2017/18 onwards) if applicable.

Filing tips: use a consistent file name format such as YYYY‑MM‑DD_description_bankName.pdf; store dated subfolders for each tax year and keep originals where possible. Retain records for at least six years after the relevant tax year and longer while any IHT or trust exposure exists — many expats choose to keep trust and rebase evidence indefinitely.

On Self‑Assessment: FIG claims and TRF designations are made on the tax return for the year the income/gain arises or the year of designation. Use clear notes in the return (and attach explanatory pages if you have complex trust or mixed‑fund issues). Check HMRC manuals (RFIG) for the expected forms of wording and keep your adviser’s instruction letters on file as proof of intent.

Short scenarios — how the new rules affect common expat profiles

Scenario A — The “new arriver”

Profile: You were non‑UK resident for 12 consecutive tax years and return to the UK in 2025. Likely outcome: eligible for FIG for your first four UK tax years. Immediate action: claim FIG on each Self‑Assessment year and model whether giving up personal allowances is still beneficial. Filing/election: FIG claim on SA; keep clear documentary proof of your 10 prior non‑residence years.

Scenario B — The returning British citizen absent for 6 years

Profile: You left the UK for six years and come back in 2025. Likely outcome: you do not meet the 10‑year test, so FIG won’t apply; your pre‑2025 untaxed funds are prospective TRF candidates only if other conditions apply. Immediate action: identify any pre‑2025 unremitted pools and talk to an adviser about TRF vs arising taxation. Filing/election: consider TRF designation in an SA return if eligible. If you also need housing finance, see our guide to UK Expat Mortgages: A Practical Guide to Apply Abroad.

Scenario C — The settlor of a trust formed in 2020 with offshore income

Profile: You funded a trust in 2020 and distributions still flow offshore. Likely outcome: trusts funded before 30 October 2024 may retain certain excluded property protections, but additions after that date are at risk and settlor taxation rules changed from April 2025. Immediate action: freeze new settlor additions and get a trust‑by‑trust legal review. Filing/election: trustees and beneficiaries must be ready to report distributions and consider TRF for historic funds.

Scenario D — The US citizen resident in the UK

Profile: A US national living in the UK after 2025. Likely outcome: UK FIG may shield some UK tax on foreign income for qualifying new arrivals, but US tax obligations (FATCA, FBAR, Form 8938, worldwide taxation) remain unaffected. Immediate action: coordinate US and UK filings; model double tax reliefs and treaty positions. Filing/election: make FIG claims on UK SA if eligible, and continue timely US returns — consult a US/UK specialist.

Where to get help and the next steps (including how ExpatsUK can support you)

This article gives practical steps but it is not tailored tax advice. For many readers the sensible next move is administrative: gather your records, do the basic FIG model, and then reach out to a specialist. ExpatsUK can help you remain organised while you find the right adviser — download the free First 30 Days in the UK: A Complete Expat Checklist and use our community threads to ask for local accountant recommendations and compare experiences. For broader relocation planning see The Ultimate Guide to Moving to the UK as an Expat.

Suggested template email to a UK tax adviser (copy/paste and edit):

Subject: Quick review request — 2025 residency, FIG/TRF and rebasing

Hello [Adviser name],

I’m a returning/arriving UK tax resident. Key facts:

- UK residency date(s): [dates]

- Prior non‑UK tax years: [years]

- Offshore balances (pre‑6 Apr 2025) and trusts: [summary + approximate values]

- Major disposals planned: [assets + timing]

I need a short call to:

1) Confirm FIG eligibility and modelling for first four years;

2) Check TRF eligibility and a pro‑forma cost/benefit at 12%/15%;

3) Confirm whether 5 Apr 2017 rebasing applies to specific assets.

Please advise availability and an estimate for a 30–60 minute advisory call.

Kind regards,

[Your name] | [Phone] | [ExpatsUK profile link if helpful]

Further reading and official sources: look for the UK government Spring Budget 2024 policy paper and HMRC’s FIG material (RFIG pages) for the manuals that support these rules. For a practical walkthrough of UK tax positions see our UK Taxes for Expats: Residency, Reliefs & Filing Made Simple guide. If you post a short anonymised summary of your case in ExpatsUK’s threads you’ll often get practical suggestions from others who have completed TRF filings or rebasing elections.

Start the checklist on ExpatsUK, collate your key documents this week, and use the community threads to shortlist UK‑qualified tax advisers before you file your next Self‑Assessment. You may also find practical budgeting tips in Saving Money in the UK: Tips Most Expats Miss.

Act now — a wrap

The abolition of domicile‑based taxation from 6 April 2025 is a major shift, but much of the risk is manageable with a short, focused plan: confirm your residency history, model FIG eligibility, consider TRF for pre‑2025 untaxed pools, look at CGT rebasing before disposals, review trust arrangements, and prepare your Self‑Assessment with specialist input. Use the free ExpatsUK checklist and our community threads to stay organised and find local adviser recommendations. If you take the six practical steps above this week you’ll significantly reduce surprise liability and be in a strong position to make confident planning choices.